Standard Home Office Deduction 2024 – The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . You have a wide range of expenses you can claim as itemized deductions, including out-of-pocket medical expenses, state and local taxes, home mortgage interest and charitable contributions. .

Standard Home Office Deduction 2024

Source : news.yahoo.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

These Are the New Federal Tax Brackets and Standard Deductions for

Source : www.barrons.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Standard Deduction 2024 Amounts Are Here | Kiplinger

Source : www.kiplinger.com

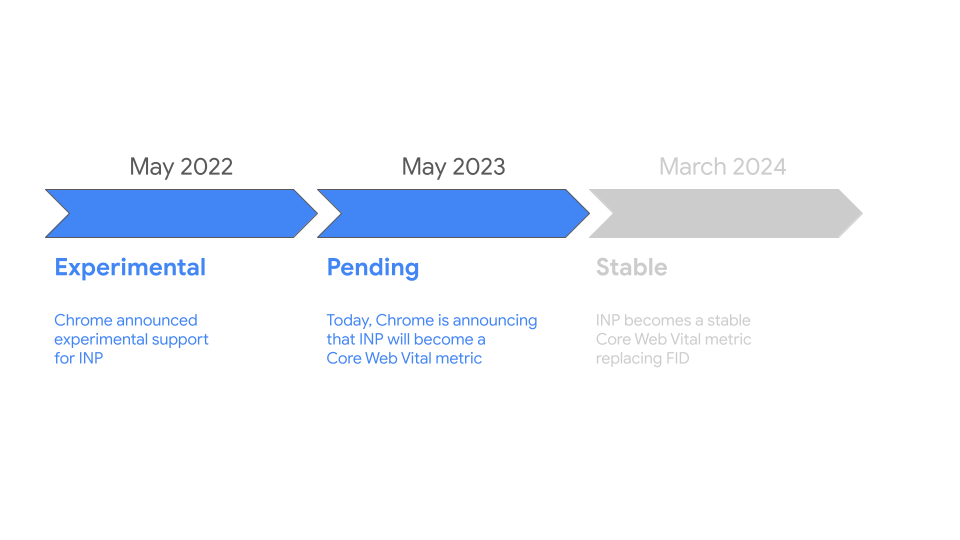

Introducing INP to Core Web Vitals | Google Search Central Blog

Source : developers.google.com

What Is the IRS Standard Deduction for 2023 and 2024?

Source : www.businessinsider.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Standard Home Office Deduction 2024 IRS announces 2024 income tax brackets – see where you fall: The IRS on Thursday announced higher inflation adjustments for the 2024 their take-home pay next year. The higher limits for the federal income tax bracket and standard deductions are intended . In an effort to alleviate the financial stress caused by persistent high inflation, the IRS has announced a series of adjustments to the standard deductions and tax brackets for the tax year 2024. The .