Irs Form 1041 Schedule K-1 2024 – But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $20,000 in . The IRS shook up the game plan for 2024, too. It said it is planning the payment and an offsetting adjustment on a Form 1040, Schedule 1. This will ensure people who unnecessarily get these .

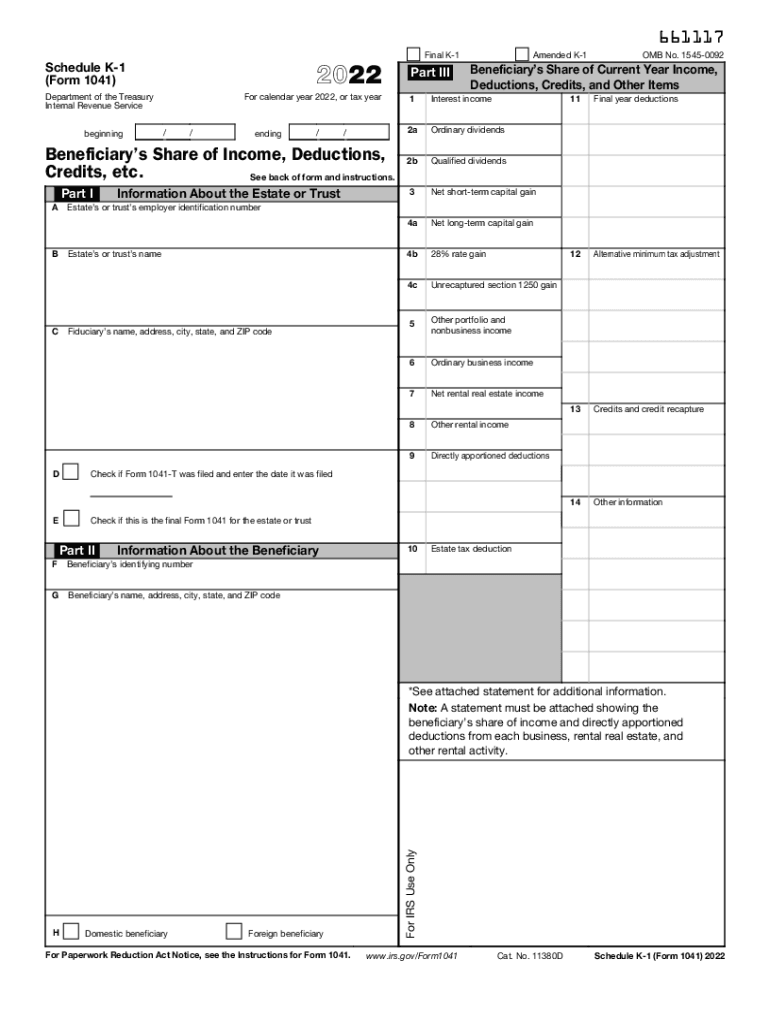

Irs Form 1041 Schedule K-1 2024

Source : turbotax.intuit.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

What is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

schedule k 1 form 1041 Archives Optima Tax Relief

Source : optimataxrelief.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

2022 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

Irs Form 1041 Schedule K-1 2024 What is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax : That means people who receive more than $5,000 in payments via PayPal and other apps in 2024 would receive the 1099-K tax form in early 2025 to complete their 2024 tax returns. For the 2025 tax . The Internal Revenue Service announced Wednesday that the amount individuals can contribute to their 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. The IRS also issued .